The Top 8 Sports Marketing Trends for 2026 (Data & Case Studies)

Quick takeaways: Sports marketing trends 2026

AI driven personalisation – No longer experimental infrastructure. Properties using AI see 40% higher retention among younger fans and 21% increased engagement from older demographics. But only if you've got the tech partners and seamless integration to make it actually add value.

Web3 fan ownership – Moving from speculation to utility. Over 50 million users globally, with Manchester City seeing 30% higher engagement from token holders. It's niche, but it's big business for the diehards.

Sustainability imperative – 82% of sponsors now require measurable environmental commitments. Paris 2024 Olympics sponsors saw 15% ROI boost from carbon neutral alignment. But let's be real about the greenwashing fatigue.

Women's sports explosion – Global interest hit 50% in 2024, WNBA viewership up 201%. Revenue projected to reach $2.35 billion by end of 2025 with 139% ad spend increase. No brainer. Watch this space.

AR and VR immersion – 35% of fans willing to pay premium for immersive experiences. Cosm video domes saw 25% ticket sales increase through 2024. Still early adopter territory, but the infrastructure is coming.

DTC streaming shift – 90 million US streaming viewers projected by end of 2025. Athletes becoming media companies with 55% of fans following them for non sport content. Every sports star is setting up their own channels. This is the future.

Gamification of engagement – Gen Z spends 21% more on interactive experiences. NBA's AR app drove 25% engagement increase through gamified features. Everything's getting gamified, and for good reason.

Non traditional sponsorships – Wellness and finance categories up 10% in 2024. Paula's Choice mental wellness campaign boosted brand awareness 45%. That's where all the money is.

Here's what nobody wants to hear about 2026.

All these trends, all this data, all these case studies mean absolutely nothing if you're not willing to spend money to make money. If you're not willing to operate always on. If you're still treating content like it's 2019.

2024 was the year AI moved from experiment to essential and fan ownership models proved they weren't just crypto hype. But 2026 is shaping up as the year that separates properties with resources from those still pretending you can win on creativity alone.

The next 12 months will be defined by volume. Not just commercial maturity and immersive media, but the brutal reality that algorithms reward volume, paid media rewards volume and attention rewards volume. You're in constant bombardment competing for eyeballs. You either get creative enough to have natural draw, niche down further, go MrBeast level broad, or you play the volume game.

And volume requires resources. You can't post once a day anymore. You need 5 to 15 times daily. You can't work with one influencer. You need six. You can't test one ad set. You need twelve variants. You can't agree on one piece of copy. You need to trial a dozen.

Want proof? During the 2025 Super Bowl, the NFL posted 152 times on Instagram, 146 times on TikTok, 236 posts on X, 123 times on Facebook and 142 times on YouTube. That's a post going live every 105 seconds. During the 2024 NFL season, the @NFL channels published 8,747 posts on Instagram alone. That averages three posts every hour for 122 days straight.

The NFL isn't alone. The NBA, Formula 1, WWE and Wimbledon are all operating at similar intensity. This isn't experimental. This is the new baseline.

This isn't just a list of what's coming. We're analysing the 8 strategic trends that will actually matter in the next 12 months, with the data and case studies that prove why they demand your attention now. But more importantly, how the volume and budget game intersects with each one.

Because understanding these trends is pointless if you're still working at the pace and polish level of three years ago.

1. AI driven personalisation in fan engagement

Personalisation is driving measurable increases in fan retention and engagement.

The Retention Engine

40%

Increase in fan retention among younger audiences with AI driven personalised experiences.

Bridging the Generation Gap

21%

Increase in engagement from fans over 50 on streaming platforms using AI personalisation.

Artificial intelligence is no longer a novelty feature that properties test with pilot programmes. It's becoming the core engine for retaining fans in a fragmented media landscape where personalised experiences can increase retention by up to 40% among younger audiences.

The global sports technology market is projected to reach $40.2 billion in 2026, with AI adoption growing at 17.5% annually. More telling is that 80% of fans believe AI will fundamentally shape how they follow sports by 2027, according to IBM's latest survey. Even more surprising, streaming platforms using AI for personalisation saw a 21% increase in engagement from fans over 50 between 2022 and 2024, proving this isn't just a Gen Z phenomenon.

We saw this transition from experimental to essential at the Paris 2024 Olympics. Peacock used AI to process 5,000 hours of coverage and generate 7 million personalised daily recaps, each narrated by an AI version of Al Michaels. The US Open followed with AI powered commentary and highlight reels that personalised each fan's app feed, driving a 25% increase in engagement.

But here's the reality most properties are missing. Sports organisations are only scratching the surface with AI driven personalisation. The ones actually benefiting are those who've already partnered with tech companies powering genuine digital transformation behind the scenes. It's got to be seamless. It's got to add value. It can't be a gimmick.

We've all seen the SORA videos now. We've listened to the 50 Cent Big Band covers. The novelty has worn off. What matters in 2026 is how AI heightens the experience and adds tangible value to the brand, product or service on offer. Not how clever your AI trick is.

The infrastructure advantage

Here's what separates winners from pretenders. Cloud infrastructure partners like AWS and Azure aren't just hosting your content anymore. They're powering the intelligence layer that makes personalisation possible at scale.

Formula 1's AWS partnership doesn't just store data. It mines historical racing information to feed predictive storytelling and broadcast features like Statbot. The NFL uses AWS computing power to generate its season schedule from over one quadrillion possible permutations, optimising competitive balance and broadcast value simultaneously. The Bundesliga employs on pitch camera systems that process data in real time, producing the Pressure Index visualisation during live broadcasts.

This is the shift most properties haven't grasped yet. The question isn't just "what platforms do we post on?" It's "what infrastructure powers our operations?" Because the properties investing in cloud partnerships and AI capabilities today are building moats that competitors can't cross without massive capital investment.

How AI changes discovery in 2026

There's another dimension to AI that most sports properties are ignoring. How fans discover you is fundamentally changing.

Traditional search is dying. Zero click searches where AI provides answers without sending users to websites are rising fast. ChatGPT controls 80% of the AI search market. Google's AI Overview now dominates sports queries, usually citing better sources than those which top traditional website rankings.

This matters because traffic to rightsholder websites is collapsing. Google's OneBox already shows fixtures, results and standings with highlights without users clicking through. Now AI Overviews are taking informational searches too. Any commercial value based around website impressions is dropping accordingly.

The shift from SEO to GEO (Generative Engine Optimisation) is here. The old game was about gaming Google's algorithm. The new game is about being the authoritative source that AI tools cite when fans ask questions.

Practical implications. Schema markup for FAQ and Person content. Author names visible on all written content. Becoming the primary cited authority on topics you own like league rules, stadia information and membership benefits. Monthly checks on what AI search is saying about you and how it answers common questions about your products.

Most properties won't do this until 2027. By then, their competitors will have already established authority with AI search engines. The window is now.

Strategic Takeaway: AI personalisation is no longer optional infrastructure. But it only works if you've got the tech partners, the integration capability and the focus on value over gimmick. Properties that don't implement it by mid 2026 will visibly lag in retention metrics compared to competitors who treat it as core capability, not experimental feature. And if you're not thinking about how AI search discovers and cites you, you're already behind.

2. Maturing Web3 and fan ownership models

Fan tokens and NFTs are becoming essential tools for community governance and digital ownership.

The Utility Market Boom

20%

Projected annual growth of the global fan token market through 2026.

Sponsorship Receptivity

67%

Global football fans who view brand sponsorships tied to Web3 as appealing (Nielsen).

Fan tokens and NFTs are evolving past the hype cycle into practical tools for community governance and digital ownership. This matters because fans increasingly demand genuine involvement beyond passive consumption, and Web3 technologies provide the infrastructure to make that involvement commercially viable.

The fan token market is projected to grow 20% annually through 2026, with over 50 million users globally. More significantly, 67% of global football fans now view brand sponsorships tied to Web3 as appealing, according to Nielsen. Web3 sports projects focused on fan governance saw a 15% adoption increase in 2024 alone.

Socios expanded partnerships across more leagues in 2024, allowing fans to vote on decisions like kit designs. Manchester City saw 30% higher engagement from token holders compared to traditional fan channels. NBA Top Shot evolved beyond simple collectibles, introducing utility NFTs that grant access to virtual experiences. The platform generated over $1 billion in sales by mid 2024.

Let's be clear about what this actually is. Web3 is for the hardcore sports fans. The diehards. And it's an interesting sector because crypto enthusiasts also happen to love sport. That's a community unto itself with significant innovation taking place.

Think about it. Trading cards, Pokemon cards, collectibles, memorabilia. It's always been big business. Web3 is just the digital evolution. It's niche, but it's massive within that niche. The legacy heritage brands, the big established leagues and rights holders are tiptoeing into it because they know it's a long term play that will pay dividends in the future.

The shift from speculation to utility is what defines 2026. Fan tokens are becoming actual membership systems with tangible benefits, not just speculative assets.

Strategic Takeaway: Web3 succeeds when it solves real engagement problems for diehard fans, not when it's bolted onto existing programmes as a gimmick. Properties should focus on governance utility and exclusive access over collectible value. This is a long game, not a quick revenue hit.

3. Sustainability as a sponsorship imperative

Measurable environmental commitments are now table stakes for major sponsorship deals.

Sponsor Commitment

82%

Sponsors who believe sustainability's importance in sports is actively growing (Sportcal 2024).

Eco-Sponsorship Growth

8.7%

Projected year-on-year growth for eco-focused sponsorship deals within the sports market.

Sustainability has moved from corporate social responsibility checkbox to commercial dealbreaker. Over 82% of sponsors believe sustainability's importance in sports is growing, according to Sportcal's 2024 report. This isn't about optics anymore. It's about whether deals get signed at all.

The sports sponsorship market is projected to hit $115 billion by end of 2025, with eco focused deals growing 8.7% year on year. By 2035, 80% of US stadiums are expected to incorporate sustainable designs. Sponsors aren't just preferring green initiatives. They're requiring them.

The Paris 2024 Olympics achieved carbon neutral status through recycled materials and green energy infrastructure. The result was a 15% ROI boost for sponsors like Coca Cola who could credibly align with measurable environmental commitments. Barclays doubled their Women's Super League sponsorship investment after the league made sustainability pledges, which contributed to 10% fan growth.

Now for the uncomfortable truth. Yes, it's hugely important that companies align around sustainability. But we're all getting tired of the greenwashing. Politics has split opinions. It's left versus right. It feels controversial to lean fully into sustainability messaging, but you also can't ignore it. So everyone's tiptoeing on the fence, wondering whether to lean in further or pull back.

Has sustainability actually created the value that was promised? Everyone knows it was a cash cow in the B2B sales and commercial space. Getting clean energy firms onto sports rights holders for promotion worked brilliantly. But is it the future? The data says sponsors require it. Consumers are showing fatigue.

The debate has shifted from whether sustainability matters to whether commitments are genuine or greenwashing. Sponsors can now measure environmental impact with the same rigour they measure reach and engagement. They're watching closely.

Strategic Takeaway: Sustainability is table stakes for securing major sponsorships in 2026. Properties need measurable environmental commitments with transparent reporting, not vague aspirational statements. But be prepared for audience fatigue and navigate the political minefield carefully.

4. Explosive growth in women's sports marketing

This isn't incremental growth, it's a fundamental market expansion and commercial priority.

Advertising Investment

139%

The increase in advertising spend projected for women's elite sports revenue by end of 2025.

Fanbase Expansion

31%

The growth of the WNBA fanbase, which expanded to 46.9 million people in 2024.

Women's sports have moved from "emerging opportunity" to established commercial priority. Global interest reached 50% in 2024, up from 45% in 2022, according to Nielsen. This isn't incremental growth. It's a fundamental market expansion.

The WNBA fanbase grew 31% to 46.9 million people, with viewership up 201% in 2024. Revenue for women's elite sports is projected to reach $2.35 billion by end of 2025, with advertising spend rising 139%. The National Women's Soccer League expansion into Boston and Denver for 2026 saw Denver's franchise fee hit $110 million, more than double previous records.

The 2024 WNBA broadcast deal attracted younger audiences through streaming platforms, with Coach's sponsorship yielding 286% ROI according to Deloitte. Media coverage of women's sports has increased 275% over the past five years, creating sustained visibility that drives commercial value.

| Metric | 2024 Performance | 2025 Projection |

|---|---|---|

| Global interest | 50% | Growing |

| WNBA viewership growth | +201% | Accelerating |

| Revenue | Growing | $2.35 billion by end 2025 |

| Ad spend increase | +139% | Significant investment |

| Women's World Cup viewership | 2 billion | Mainstream event |

What's driving this isn't just female fans. It's Gen Z across genders seeking authentic, diverse sports content. Women's sports deliver higher purchase intent among younger demographics compared to saturated men's leagues.

This is the no brainer of 2026. Watch this space because if anything, the growth is just getting started. I was just watching Red Bull Rampage with women competing down those mountains, and it's awe inspiring. Even as someone who understands how dangerous that is, seeing them get the coverage and eyeballs they deserve is excellent.

Now they've got the attention. Now the commercial infrastructure is building. Now brands are seeing the ROI data. This isn't experimental anymore. This is where the smart money is going.

Strategic Takeaway: Women's sports represent the highest growth category in sports marketing for 2026. Properties and brands still treating this as experimental are missing the commercial reality that's already here. Get in now or watch competitors capture the value.

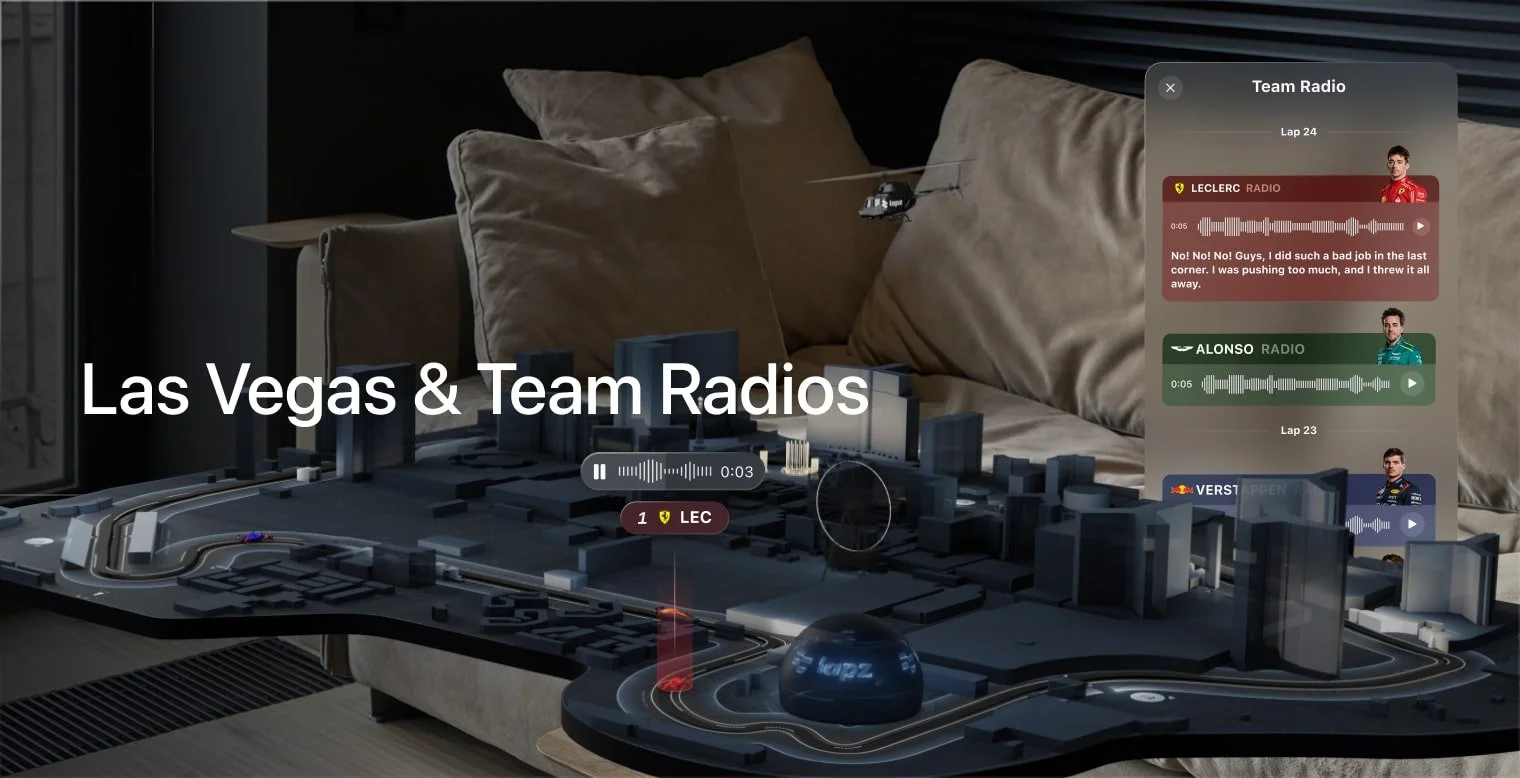

5. AR and VR for immersive fan experiences

Immersive technology is expanding the audience beyond physical venue capacity.

Market Expansion

25%

Projected growth of the Augmented and Virtual Reality sports market by 2026.

Premium Willingness

35%

Percentage of fans willing to pay premium prices for immersive AR and VR sports experiences.

Augmented and virtual reality technologies are creating "phygital" experiences that blend physical attendance with digital enhancement. The AR and VR sports market is projected to grow 25% by 2026, with 35% of fans willing to pay premium prices for immersive experiences.

This matters because live event costs are rising while younger fans expect technology driven engagement. 80% of fans expect technologies like AR to fundamentally shape how they experience sports by 2027, according to IBM. Immersive venues saw 20% attendance growth in 2024.

Cosm's video domes offered shared reality experiences for NFL games in 2024, with Atlanta expansion driving 25% ticket sales increases. UFC 306 at Sphere generated $20 million through AR enhanced broadcasts that let remote viewers feel present at the event.

The reality check. This is still early adopter technology. But there are some genuinely cool products, apps and digital experiences available now. The video dome concept is brilliant. Think about it. Very interactive, immersive 3D movie experiences combined with live event experiences.

Watch the big stadiums because they've got the infrastructure and can develop really compelling fan activations. If it's not on your device natively, you'll get third party peripherals to experience these things. And as the technology becomes cheaper, there will be more live activation opportunities and immersive fan experiences available.

The key shift is accessibility. VR is no longer just for wealthy early adopters. It's becoming a practical solution for fans who can't afford or access live events but want more than traditional broadcast.

Strategic Takeaway: Immersive technology is solving the accessibility crisis in live sports. Properties that implement AR and VR aren't chasing novelty. They're expanding their addressable audience beyond physical venue capacity. Still early, but the infrastructure is coming fast.

6. Direct to consumer streaming and athlete owned media

Owning distribution drives higher engagement and controls the fan relationship.

Market Scale

90M

Projected US sports streaming viewers by the end of 2025 (up from 57M in 2021).

Gen Z Retention

40%

Increase in retention among Gen Z viewers achieved by alternative, creator-led broadcasts (e.g., ManningCast).

Direct to consumer streaming empowers leagues and athletes to own distribution, bypassing traditional broadcasters for personalised, creator led content. US sports streaming viewers are projected to reach 90 million by end of 2025, up from 57 million in 2021, according to PwC.

Athletes are becoming media companies themselves. 55% of fans now follow athletes for non sport content, with athlete endorsements growing 30% in 2024. Alternative broadcasts like ManningCast boosted retention by 40% among Gen Z viewers who find traditional commentary boring.

ESPN's DTC launch in 2024 integrated betting and shopping directly into streams, with alternative commentary from figures like David Beckham for UEFA coverage. LeBron James' SpringHill Company produced docuseries that drove 28% increase in fan engagement with health and wellness content.

This is the clearest continuation trend of them all. It's a no brainer. Direct to consumer is on the rise and it's not stopping. You can see it. All the big sports stars are setting up their own YouTube channels, their TikTok channels, their TikTok stores.

This trend fundamentally changes revenue models. Instead of selling rights to broadcasters, properties and athletes capture subscription revenue directly while maintaining control over content and data. And crucially, they control the relationship with fans.

Traditional broadcast deals are becoming legacy revenue. They're still significant, but they're the past. DTC streaming represents future growth, and every property needs to be building that infrastructure now.

Main character energy wins

Here's what most properties are missing about DTC. The more time passes, the less interest fans have in hearing from institutions.

All the major platforms prioritize creators. Fans follow people, not organisations. Athletes, pundits, creators. Rightsholders can't control the message because they don't control the distribution anymore.

Multiple research sources describe modern fans being more drawn to a sport by an athlete than a team, particularly in younger age cohorts. There are parallels elsewhere in entertainment where solo artists now dominate music compared to bands and in gaming where players spend more time watching streamer videos than playing games.

Concurrently, news consumption is increasingly flowing through individual creators, podcasters and newsletter writers at the expense of traditional media publishers.

Here's the reality. As trust in institutions declines, sports need to build it in their people instead. Prioritize the development of on camera talent within the club, league or federation. Leverage all the tools that platforms give creators. Spend more time broadcasting live on YouTube, TikTok and Instagram. Get involved in the chat with your audience.

Put author names on written content. Not just for SEO, but because it's one of the few technical steps you can take to signal to AI search engines that your content has authenticity and authority.

All of this means being good at a different kind of business to the one most rightsholders operate now. But building parasocial trust (the equity that audiences used to feel with TV presenters but now have with creators) is essential for any sports organisation that wants to lead the conversation.

If you've already got a buoyant creator ecosystem producing content around your sport, actively work with them. Give access to content. Whitelist their channels so you don't strike claims against them. Give them access to your athletes and venues.

Creators, Discord admins and the mods of your subreddits should be invited to media days and sent official communications announcements. They are as important as any of your traditional media relationships.

The long form paradox

There's a counter trend here that deserves attention. While everyone's obsessing over Reels, Shorts and TikToks, long form content is surging.

Podcasting has transitioned to a video first medium, driven by high viewership of long form episodes. YouTube became the world's most popular podcast platform in 2025, ahead of Apple and Spotify. Netflix signed The Ringer to broadcast its shows on the streaming service. According to Nielsen, YouTube has consistently achieved the largest share of television watch time among media companies in 2025.

Connected TV viewership accounts for the largest share of watch time on YouTube, ahead of both mobile and web viewing. Creators on Twitch achieved record breaking results through marathon streaming efforts. US creator Kai Cenat became the first channel to pass one million active paid subscribers. Spain's Ibai Llanos broke his own record with a peak concurrent viewership of 9.3 million on a stream.

Modern audiences are not inherently anti long form. They're anti being bored.

If sport over prioritizes short form platforms and content initiatives, it risks sacrificing engaged relationships with the next generation of fans and becoming just another content format to scroll past.

Short form vertical video serves a clear purpose. It grabs attention and creates interest. It's essential to have a regular conveyor belt of this format across multiple platforms. This is critical top of the funnel content marketing activity.

But many properties have over corrected. They now prioritize this format at the expense of potentially more meaningful ones. You're constantly offering your audience entrees when some are looking for a main course.

Sports publishers must use vertical video content to point audiences towards what else they should see or know. This often means longer formats that offer deeper storytelling and convert viewers from simply curious to those who care.

Strategic Takeaway: Traditional broadcast deals are becoming legacy revenue while DTC streaming represents future growth. Properties need to balance short term broadcast money against long term direct relationships with fans. Start building your owned channels now. The athletes certainly are. And don't sacrifice long form engagement for short form volume. Modern fans will watch for hours if you don't bore them.

7. Gamification and interactive fan communities

Transforming passive viewers into active participants with rewards and challenges.

Gen Z Spending

21%

The increase in spending by Gen Z on interactive experiences vs. passive consumption.

Social Viewing Scale

42%

Percentage of fans who engage in social viewing monthly (up 15% since 2023).

Gamification transforms passive viewing into active participation through rewards, challenges and augmented reality elements. This matters because Gen Z fans spend 21% more on interactive experiences compared to passive consumption, according to PwC.

42% of fans engage in social viewing monthly, up 15% since 2023. Gen Z fans are 1.4 times more likely to attend events in person, spending an average of £70 more on tickets when events incorporate interactive elements. TGL golf league attracted 32% of its audience from people who don't typically watch traditional golf.

The NBA launched an AR app in 2024 that gamified ticketing and allowed fans to make real time predictions, increasing engagement by 25%. Pickleball's #ProPickle campaign used social gamification to drive 141% follower growth for Nature Made's sponsorship.

The insight here is simple. Everything's getting gamified, and for good reason. It's taking the Apple Watch fitness tracking mentality and applying it to everything. More sophisticated mechanics, more reward loops, more ways to make passive audiences active participants.

The strategic insight is that younger audiences don't distinguish between physical and digital experiences. They expect both simultaneously, with seamless transitions between watching, participating and sharing.

Strategic Takeaway: Gamification isn't about adding games to sports. It's about making sports themselves more participatory. Properties that still treat fans as passive audiences are losing Gen Z to properties that let them actively engage. Build the interactive layer or lose the next generation.

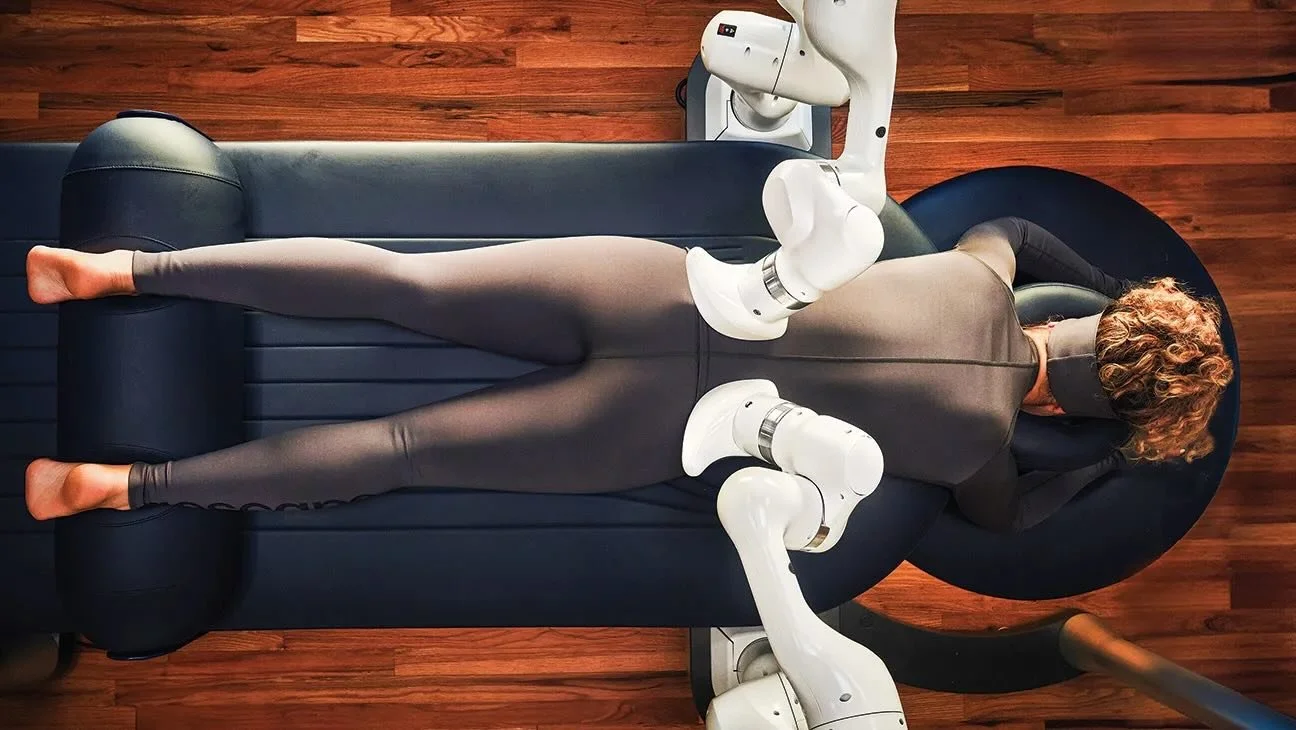

8. Non traditional sponsorships in wellness and finance

Growth driven by wellness, finance, and partnerships aligned with fan personal values.

Fan Preference Shift

67%

Percentage of fans who favor sponsorships aligned with personal values, not just team logos.

Wellness Sector Growth

20%

Growth rate of sponsorship deals in the holistic health and wellness categories in 2024.

Sponsorship categories are expanding beyond traditional automotive, beverage and apparel into mental wellness, financial services and holistic health. Non traditional sponsors grew 10% in 2024, with wellness deals rising 20%, according to Lumency's Global Sponsorship Report.

This matters because 67% of fans now favour sponsorships aligned with personal values, not just team logos. 28% of fans follow health and wellness content from teams, up 10% from the previous year. Athletes as investors in brands they endorse generated $1 billion annually for brands like Cristiano Ronaldo's CR7.

Paula's Choice partnered with Ilona Maher for a mental wellness campaign in 2024 that boosted brand awareness 45%. Megan Rapinoe's investment fund backed wellness startups, yielding 15% fan purchase increases when she promoted portfolio companies.

Athletes are moving from endorsers to equity partners, creating authentic alignments that younger audiences reward with actual purchases. The strategic shift is from transactional sponsorships to integrated brand partnerships.

Why this matters commercially. Wellness and finance. That's where all the money is. These companies need to maintain their market share by achieving greater awareness, and they're looking at sports where there are captive audiences willing to engage with these topics.

The authenticity angle isn't just marketing speak. Younger audiences can smell a transactional endorsement from a mile away. When athletes have actual equity stakes and genuine belief in the brands they promote, the purchase intent follows.

Strategic Takeaway: Sponsorships in 2026 are dynamic, data driven partnerships between athletes and brands, not static logo placements. Authenticity and equity alignment matter more than reach alone. Expect wellness and finance categories to continue growing aggressively.

The brutal commercial reality of 2026

Here's what separates winners from losers in 2026.

All these trends are real. The data proves it. The case studies validate it. But none of it matters if you're still operating like it's 2022.

You need to be less polished, more experimental. You need to be more reactive with a proactive back structure that enables rapid response to opportunities. Trends last 10 days now, not two weeks. If you want to be part of the conversation, you need to jump in during the first five days. Push it to seven if you must. Anything after that and you look late to the party.

That means having content, creative and distribution ready to deploy immediately. Not next week. Not after three rounds of approvals. Immediately.

To be rewarded by algorithms, you need to reward the algorithms. It sounds basic because it is basic. But most properties still aren't doing it.

The volume game requires resources. You need budget for paid media amplification. You need team capacity for constant content production. You need technology infrastructure for rapid deployment. You can use AI tools to help create volume, but you need the human touch for refinement, review, curation, moderation and amplification.

AI personalisation is infrastructure. Cloud partnerships are competitive moats. AI search is rewriting discovery. Sustainability is a dealbreaker, even with the greenwashing fatigue. Women's sports are established, not emerging. Direct relationships with fans matter more than broadcast reach. Athletes are media companies, not just endorsers. Individual voices trump institutional messaging. Long form engagement complements short form volume. And all of it requires volume, budget and speed to execute.

Understanding these trends is the first step. The next is learning how to implement them at the pace and scale that 2026 demands. Whether you're preparing for an interview, building a go to market strategy or evaluating where to invest resources, these eight trends will define who wins in 2026.

But only if you're willing to resource them properly. Only if you're willing to move faster than you're comfortable with. Only if you're willing to kill the polish in favour of volume and speed.

That's the part nobody wants to hear. But it's the truth that will separate the winners from the rest.

| Old Way (2022) | New Reality (2026) | Multiplier |

|---|---|---|

| 1 post per day | 5-15 posts per day | 5-15x |

| 1 influencer partnership | 6+ influencers | 6x |

| 1 ad set | 12 ad variants | 12x |

| 1 piece of approved copy | Test a dozen variations | 12x |

| Trend relevance window | 10 days maximum (act in first 5-7) | Speed critical |

If you're looking for a sports marketing consultant to help your property navigate these shifts and build strategies that deliver measurable commercial results, I work with sports, events and entertainment brands to turn these trends into executable roadmaps.

THE INTERVIEW IS TOMORROW.

You've read the article. Now ace the interview. Get the "Sports Marketing Interview Cheat Sheet." This 10-page PDF has expert answers, talking points on the 2025 trends and more.

Buy Now for £19.99Need help implementing these strategies?

With 15 years scaling global sports and entertainment properties, I now work as a fractional CMO UK helping brands turn marketing into measurable commercial results. Whether you need diagnostic strategy, urgent launch leadership or ongoing fractional CMO support, I embed with your team to deliver results.

Flexible engagement models from day rates to retained partnerships.

Former CMO RunGP | Marketing Director E1 Series | Head of Marketing SailGP | Senior Marketing Manager Formula E